The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Blog Article

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Table of ContentsSome Known Facts About Mileagewise - Reconstructing Mileage Logs.Unknown Facts About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedUnknown Facts About Mileagewise - Reconstructing Mileage LogsEverything about Mileagewise - Reconstructing Mileage LogsHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Range feature recommends the quickest driving route to your workers' location. This feature enhances productivity and contributes to cost savings, making it an essential possession for services with a mobile labor force.Such a technique to reporting and compliance streamlines the frequently intricate job of handling gas mileage expenses. There are lots of advantages related to using Timeero to monitor gas mileage. Let's have a look at several of the app's most notable attributes. With a trusted gas mileage monitoring device, like Timeero there is no requirement to fret about inadvertently omitting a date or item of information on timesheets when tax obligation time comes.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

These added verification procedures will certainly maintain the IRS from having a reason to object your gas mileage records. With exact mileage tracking modern technology, your employees don't have to make rough gas mileage quotes or also stress concerning mileage cost monitoring.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all auto costs. You will certainly need to proceed tracking gas mileage for work also if you're making use of the actual expense method. Keeping mileage records is the only method to separate organization and individual miles and offer the evidence to the internal revenue service

The majority of mileage trackers allow you log your trips by hand while determining the range and repayment quantities for you. Many also included real-time journey monitoring - you need to start the application at the beginning of your trip and quit it when you reach your final destination. These applications log your start and end addresses, and time stamps, along with the overall range and compensation amount.

Excitement About Mileagewise - Reconstructing Mileage Logs

One of the inquiries that The IRS states that car costs can be taken into consideration as an "common and necessary" cost during operating. This consists of expenses such as gas, Look At This upkeep, insurance policy, and the car's devaluation. However, for these prices to be thought about deductible, the vehicle needs to be used for organization functions.

More About Mileagewise - Reconstructing Mileage Logs

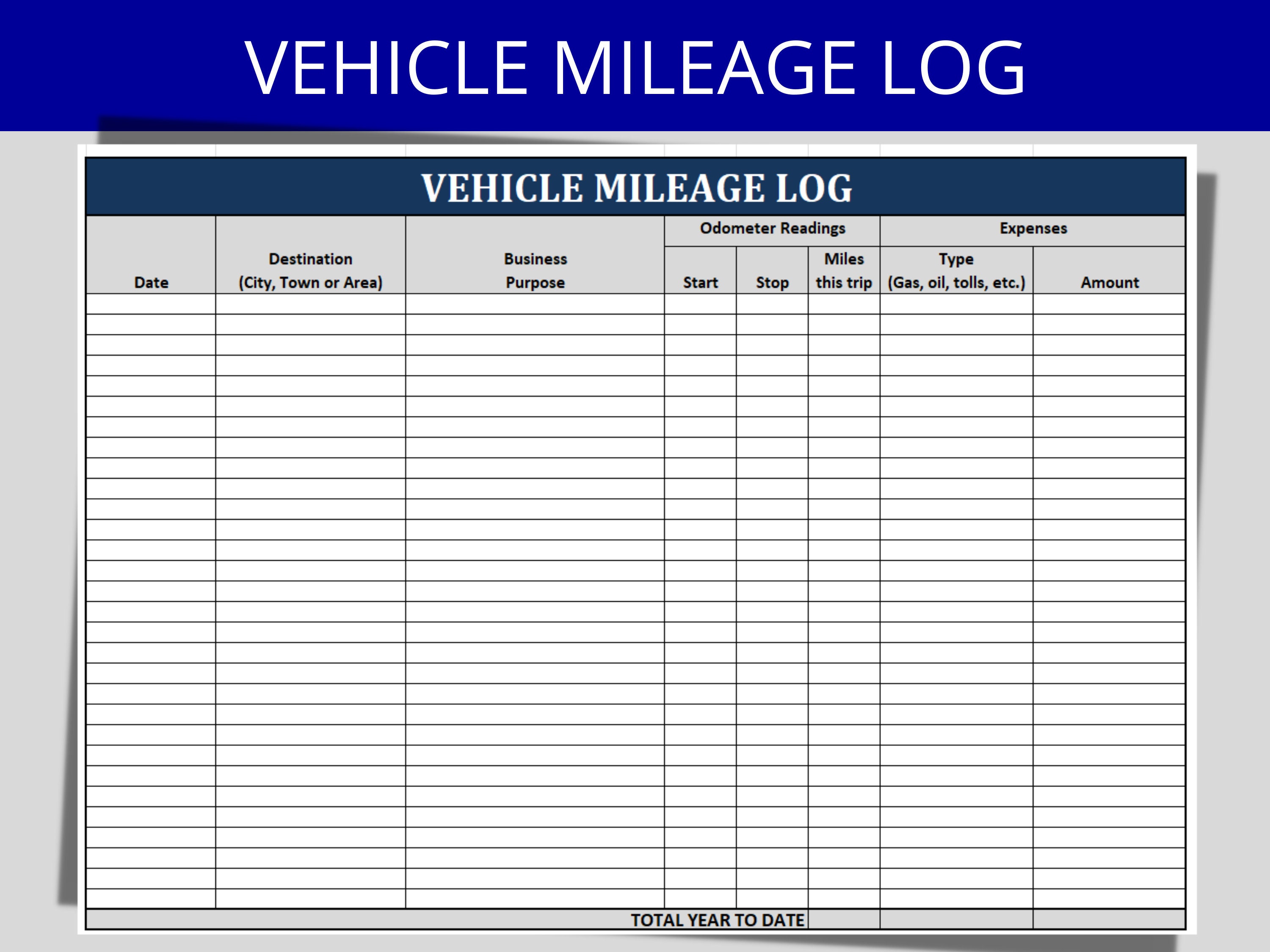

In in between, diligently track all your business journeys noting down the starting and ending readings. For each journey, document the place and company purpose.

This includes the complete business gas mileage and overall gas mileage build-up for the year (company + individual), journey's day, location, and objective. It's vital to videotape tasks without delay and maintain a synchronic driving log describing date, miles driven, and organization purpose. Below's exactly how you can boost record-keeping for audit functions: Start with making certain a careful mileage log for all business-related travel.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

The actual costs approach is an alternative to the basic gas mileage price method. Rather than calculating your deduction based on a fixed rate per mile, the actual expenses technique permits you to deduct the real expenses related to utilizing your lorry for business purposes - simple mileage log. These expenses consist of fuel, maintenance, repair services, insurance, depreciation, and other relevant expenditures

However, those with considerable vehicle-related expenditures or unique problems might gain from the actual costs method. Please note choosing S-corp status can transform this estimation. Ultimately, your picked technique must straighten with your specific monetary objectives and tax situation. The Requirement Mileage Rate is an action released annually by the IRS to figure out the deductible expenses of operating a vehicle for business.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

(https://mi1eagewise.wordpress.com/?_gl=1*97e58h*_gcl_au*MTk0MDgxMjc2OC4xNzMyMTc0Njc0)Compute your complete business miles by utilizing your begin and end odometer analyses, and your videotaped business miles. Properly tracking your specific mileage for organization trips aids in corroborating your tax obligation deduction, specifically if you opt for the Standard Gas mileage technique.

Keeping an eye on your mileage by hand can call for persistance, yet keep in mind, it could conserve you cash on your taxes. Comply with these steps: Jot down the date of each drive. Videotape the overall gas mileage driven. Think about noting your odometer readings prior to and after each journey. Write the starting and ending points for your journey.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

And currently almost every person uses General practitioners to get around. That implies almost every person can be tracked as they go regarding their organization.

Report this page